Tax Brackets 2024 Salary Kenya

Tax Brackets 2024 Salary Kenya. Guidelines on tax amnesty 2023/2024; A quick and efficient way to compare monthly salaries in kenya in 2024, review income tax deductions for monthly income in kenya and estimate your 2024 tax returns for your.

The rate of value added tax is 16% with effect from 1st january, 2021. The kenya tax calculator includes tax.

Income From $ 288,000.01 :

Specifically, 32,5% and 35% paye rates were introduced for.

Kenya Revenue Authority, Is An Agency Of.

If you make ksh 70,000 a year living in kenya, you will be taxed ksh 7,900.

For A Ksh 30,000 Monthly Salary, The Taxable Income Falls Under The 10% Bracket.

Images References :

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

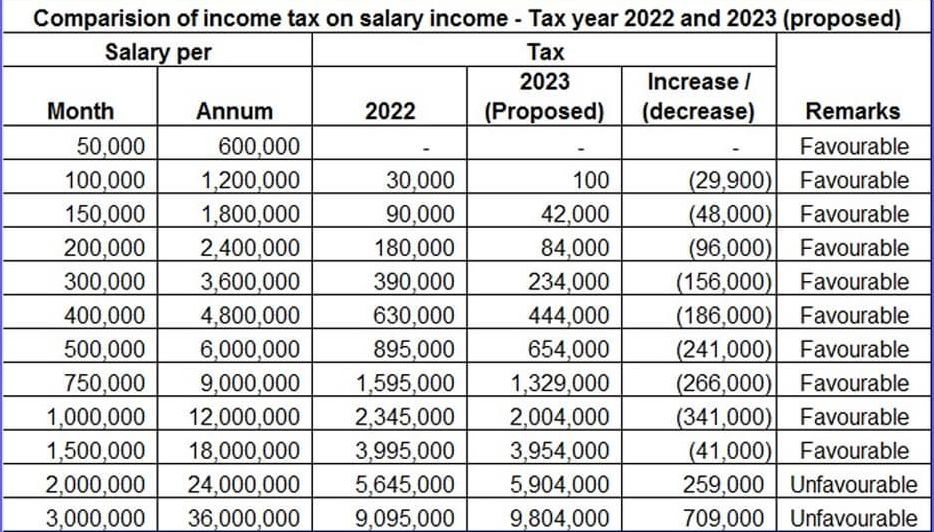

Irs New Tax Brackets 2024 Elene Hedvige, On the first ksh 288,000: On the first ksh 24,000:

Source: sokodirectory.com

Source: sokodirectory.com

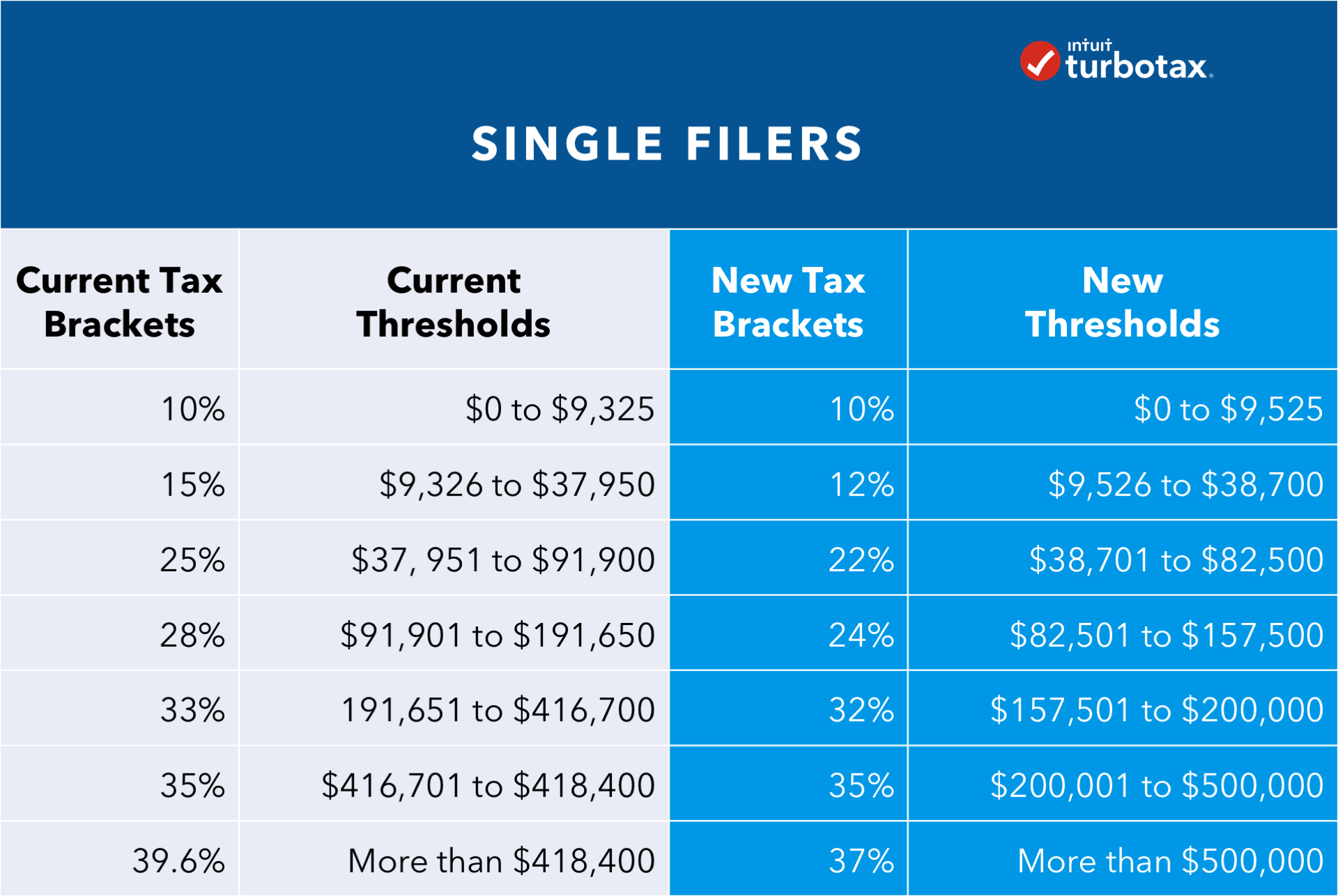

New salary Structure to save Ksh 8 Billion for Kenya taxpayers, If you make ksh 70,000 a year living in kenya, you will be taxed ksh 7,900. Guidelines on tax amnesty 2023/2024;

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, Kenya paye calculator with income tax rates of january 2024 | calculate paye, net pay,. If you make ksh 70,000 a year living in kenya, you will be taxed ksh 7,900.

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

What Are The Different Tax Brackets 2024 Eddi Nellie, Specifically, 32,5% and 35% paye rates were introduced for. The 2024 monthly salary comparison calculator is a good calculator for comparing salary after tax in kenyaand the changes to the kenya income tax system and personal.

Source: story.com.pk

Source: story.com.pk

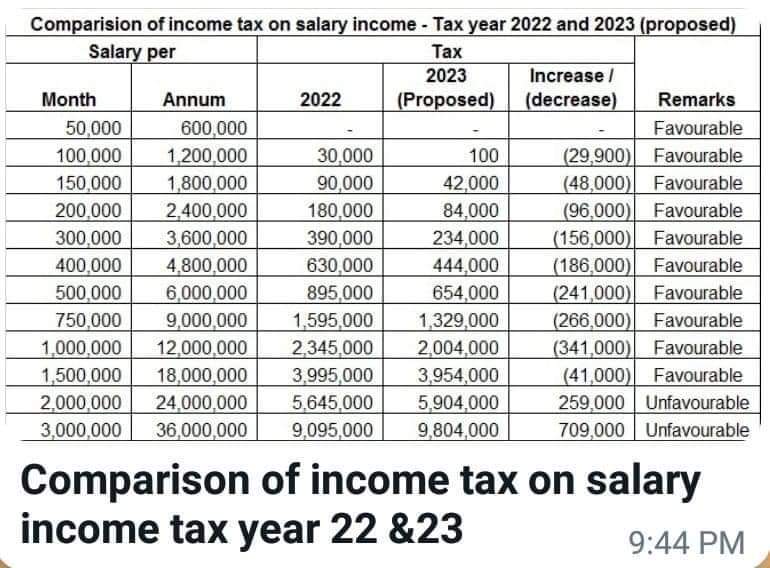

Comparison of Tax on Salary 20242025, For a ksh 30,000 monthly salary, the taxable income falls under the 10% bracket. Follow these simple steps to calculate your salary after tax in kenya using the kenya salary calculator 2024 which is updated with.

Source: propakistani.pk

Source: propakistani.pk

New Tax Slabs Introduced for Salaried Class in Budget 202223, A quick and efficient way to compare monthly salaries in kenya in 2024, review income tax deductions for monthly income in kenya and estimate your 2024 tax returns for your. Kenya residents income tax tables in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: selestinawmandi.pages.dev

Source: selestinawmandi.pages.dev

Updated Tax Brackets 2024 For Single Flo Rozella, On the first ksh 288,000: The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in kenya.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, Sample our free monthly income tax calculator below and talk to us today for your various tax compliance & advisory needs. Find out how much is your net pay after income taxes.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, The rate of value added tax is 16% with effect from 1st january, 2021. That means that your net pay will be ksh 62,100 per year, or ksh 5,175 per month.

Source: www.youtube.com

Source: www.youtube.com

Monday Night News national treasury revise the taxes Kenyans pay to, The first return under the new rate is due by 20th february, 2021. On the next ksh 8,333:

If You Make Ksh 70,000 A Year Living In Kenya, You Will Be Taxed Ksh 7,900.

The rates are progressive, meaning that the higher your income, the higher your tax.

Find Out How Much Is Your Net Pay After Income Taxes.

Income from $ 288,000.01 :